car lease tax deduction calculator

All Other Years Overdue click to learn more. Car repairs are tax deductible as part of a group of car-related expenses.

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Once an agreement is in place your employer deducts money from your wage and the deduction is used to pay for the vehicle.

. Lets be honest - sometimes the best fica tax calculator is the one that is easy to use and doesnt require us to even know what the fica tax formula is in the first place. Calculate the cost of owning a car new or used vehicle over the next 5 years. Theres no tax credit for buying a used electric car no matter how efficient it is.

You can finish any tax return right now online with friendly support. You might have driven 18000 miles during the tax year but you could only claim 33 of your overall qualifying auto expenses on Schedule A if you drove 6000 of those miles for business purposes because 33. It Doesnt Apply to Leased Vehicles If youre leasing a new EV the tax credit will go to the.

Edmunds True Cost to Own TCO takes depreciation. This includes business owners other self-employed workers armed forces reservists and fee-basis government officials who use a car for business purposes. Make calculating FICA tax online a snap try out the free online FICA tax calculator now.

But if you want to know the exact formula for. Tax and NI Calculator for 202122 Tax Year This Tax and NI Calculator will provide you with a forecast of your salary as well as your National Insurance Contributions for the tax year of 202122. However only certain individuals are eligible to claim a tax deduction related to car expenses.

How to Calculate FICA Tax. A novated lease is an agreement between you your employer and the provider. You enter into a finance lease and a second agreement called a novation agreement is used to transfer part of your lease payments to your employer.

But youre limited to a deduction equaling the percentage of miles you drove your car for business purposes rather than personal reasons. Enter your Salary and click Calculate to see how much Tax youll need to Pay. When you are looking at the federal tax brackets you are able to determine which tax rate applies to you for the current tax season which allows you to go on and determine how much tax you will be paying based on your incomeEach year federal tax rates are changed meaning that each year the tax you pay will most likely differ from the previous year.

2021 Tax Return For your income between 01 July 2020 30 June 2021 Click To Start Your 2021 Tax Return 2020 Tax Return For your income between 01 July 2019 30 June 2020 Overdue click to finish now.

Can Car Repairs Be Considered Tax Deductible By Hogan Sons Tire And Auto Medium

Your Complete Guide To Bik Tax Parkers

Lease Car Through Your Business Tax Calculator Uk Tax Calculators

Business Tax Relief On Leased Vehicles Car Lease 4 U

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Are Car Lease Payments Tax Deductible Lease Fetcher

How Is Car Lease Tax Benefit Calculated In India For Individual Salaried Employee Who Uses The Car For Both Official And Personal Purpose Can You Explain With An Example Quora

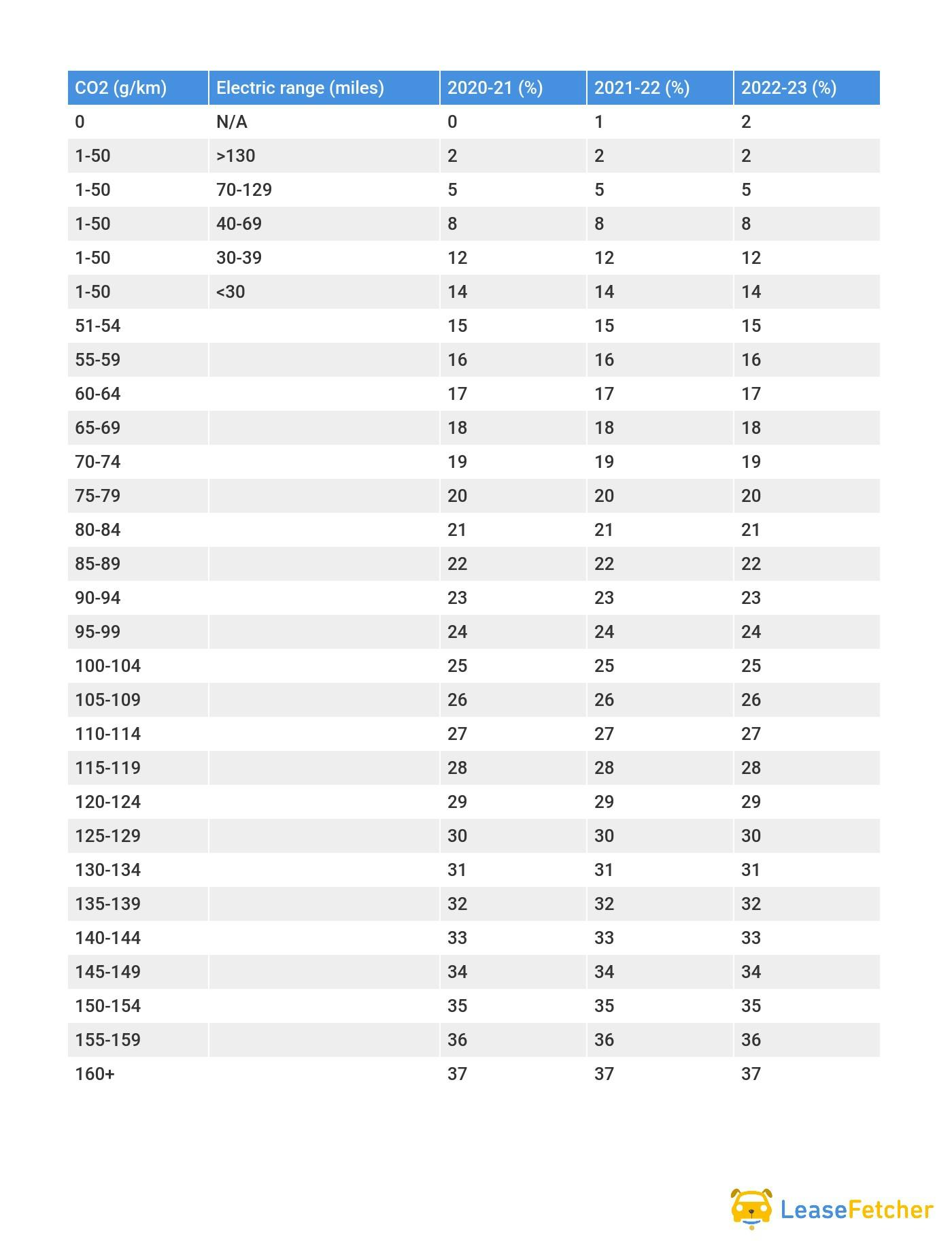

Company Car Tax On Electric Cars How Much Do You Pay Lease Fetcher

How Does Company Car Tax Work Lease Fetcher

Tax Implications Of Business Car Leasing Company Car Lease Tax

A Guide To Company Car Tax For Electric Cars Clm

How To Lease A Car When You Can T Afford To Buy One Buy Vs Lease Calculator Quote Com

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Writing Off A Car Ultimate Guide To Vehicle Expenses

What Is An Allowable Deduction For Corporation Tax Inspire Accountants

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global